If managing your personal finances takes on the same complexity as running a business, it may be time to consider starting a family office.

A family office can provide insight and transparency into your spending, while helping you invest and preserve your wealth for future generations.

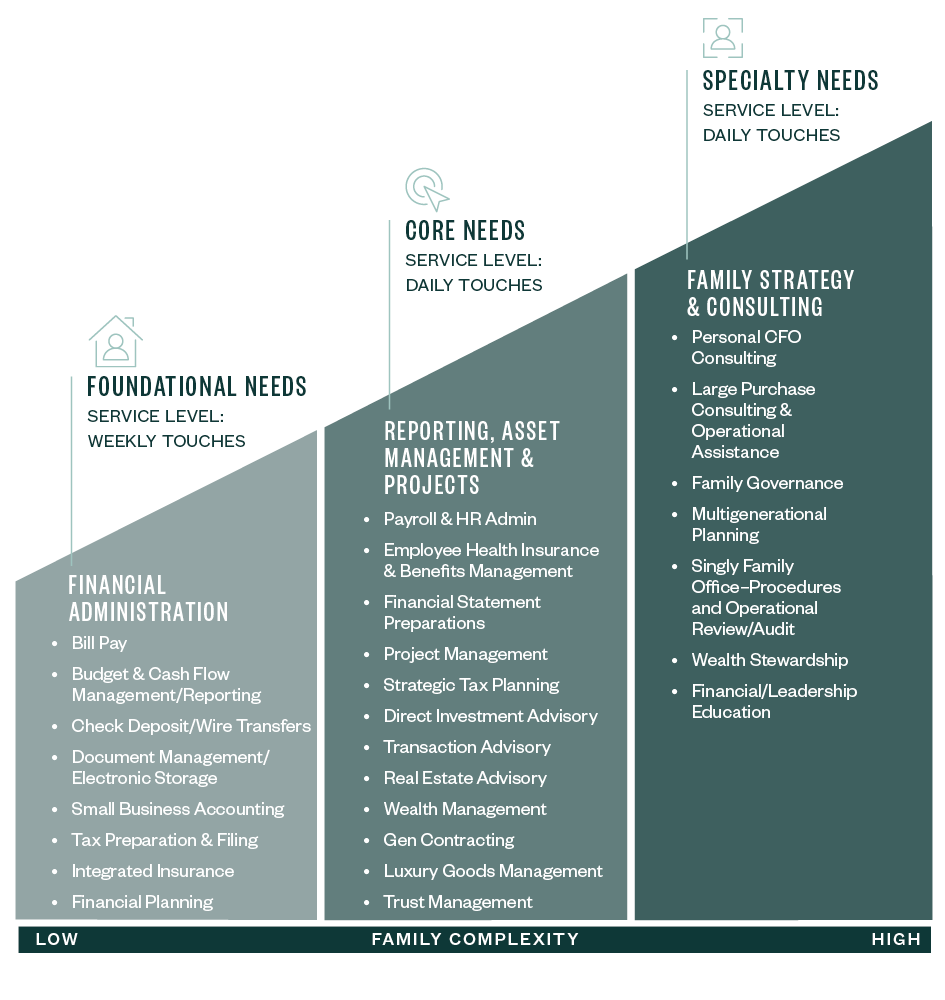

Below, learn how a family office can simplify your finances, provide peace of mind, and more.

What Is a Family Office?

A family office is a personal financial team that’s designed to streamline a family or individual’s accounts, spending, and investing.

These teams can manage complex financial structures, assets, and investments, while helping individuals preserve and protect wealth for future generations. Family office teams can be fully in-house, fully outsourced, or a combination of in-house and outsourced resources coming together.

Family offices become helpful when individuals accumulate more wealth than a principal or single bookkeeper can efficiently—and accurately—manage.

Components of a Family Office Team

What Qualifies as a Family Office?

While nearly any financial team can qualify as a family office, some structures are more effective than others.

Here are a few family-office approaches individuals often take.

Self-Managed Personal Affairs

Self-managing your personal affairs means you continue to pay your bills and manage other personal operations.

Often, a personally managed family office distributes responsibilities across family members. For example, a spouse could act as the primary bill payer or person designated to handle the home operations.

Alternatively, the individual or family could hire a single bookkeeper or continue to use a business-employed executive assistant to assist with portions of the family office. However, the key decision makers are still in charge of managing the family’s personal affairs.

Single-Family Office

Individuals sometimes create their own single-family offices, which are structured like businesses, to manage their personal affairs and investments. Single-family offices can be composed of family members, friends, business partners, and professional employees.

With enough wealth and the right team, a single-family office can be the right answer for an individual or family. However, families should review the following considerations before pursuing this approach.

- Cost. Personal CFOs and CIOs often require high salaries and sometimes request a portion of investments. Additionally, the family would need to consider the cost of a support team, office space, and overhead, which can ramp up quickly.

- Experience. When choosing your team, pick someone who’s done it before. Individuals often choose a team they know and have worked with in the past. However, they don’t always choose professionals experienced in managing an individual’s full financial picture. Also, because this team will likely only work for the one family, it may not know industry standards.

- Short tenure and transition problems. Single-family office teams can have high turnover. The benefit of historical data can be lost with when employees leave frequently. On the other hand, those that have longer tenure often don’t have transition plans for when they leave or retire.

- Lack of transparency and fraud. Process and procedure are important for safe practices. Inexperienced employees can make mistakes, mishandle money, or give sensitive financial information to the wrong people. When establishing a single-family office, it’s important to establish good practices for handling finances and information safely. It’s also key to periodically have these practices tested by a third-party professional.

- Control and focused commitment. The benefit to a single-family office is that the employees are solely focused on you and your family. The employees don’t need to balance their time between different families as they do in a multifamily office. Additionally, if you prefer responses during off hours, you’re more likely to receive responses on nights and weekends if you establish those requirements as necessary for the single-family office.

Multifamily Office

Some or all of an individual’s family office needs can be outsourced to a multifamily office. This structure contains pre-agreed upon fees and transparency, which can provide peace of mind. It also includes a system of checks and balances that helps reduce the risk that individual finances aren’t being mishandled or falling through cracks.

This approach is effective when managed by an experienced firm that applies systems and research that are proven to work. A few key areas of this approach to consider include:

- Cost. A multifamily office is generally less expensive and less complicated to manage because an individual engages a professional firm to do the work. That means they don’t have to consider employee salaries, benefits, office space, or overhead.

- Qualified team utilizing like-client experiences. Generally, a client is assigned to a qualified team that serves that client and other clients. This allows the team to apply experience gained on one client to another and provide best-in-practice processes, procedures, and recommendations.

- A system of internal controls and adequate segregation of duties. A well-structured multifamily office utilizes documented processes and procedures for good safety practices. It should also have a system of internal controls and segregation of duties that includes proper levels of review. These systems prevent any one person from having too much insight into the family’s finances or control over spending.

- Control and focused commitment. Multifamily offices are just that, a firm that works for multiple families. That means your team of advisors isn’t focused on just you and your family full-time. Although a good team should make each client feel they’re the priority, the team must balance their time among various clients. Additionally, multifamily offices are professional service firms and often expect reasonable business hours to be respected unless an emergency occurs.